child care for working families act cbo

Before sharing sensitive information make sure youre on a federal government site. The gov means its official.

G O P Health Bill Would Leave 23 Million More Uninsured In A Decade C B O Says The New York Times

1115 text nicknamed the Recovery Act was a stimulus package enacted by the 111th US.

. By CBOs estimate revenues were 850 billion or 21 percent higher and outlays were 548 billion or 8 percent lower than they were in fiscal year 2021. The original Social Security Act was enacted in 1935 and the current version of the Act as amended encompasses several social welfare and social insurance. 19001 This section requires the Secretary of the Senate to use specified funds to reimburse the Senate Employee Child Care Center for personnel costs incurred starting on April 1 2020 for employees who have been ordered to cease working due to measures taken in the Capitol complex to combat the coronavirus outbreak.

We must decide in these cases whether the Religious Freedom Restoration Act of 1993 RFRA 107 Stat. Congress and signed into law by President Barack Obama in February 2009. The federal budget deficit was 14 trillion in fiscal year 2022 the Congressional Budget Office estimatesabout half of last years deficit of 28 trillion.

In the United States dissimilar to the European nationalized health insurance plans the market created a private employment-based system. Nearly half 46 percent of custodial parents. One byproduct of this tax rate reduction was that it brought to prominence a previously lesser known provision of the US.

11597 text is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act TCJA that amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates for. The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 PubL. The list includes nurses doctors hospitals teachers churches and more.

In states without a 15 minimum wage law public supports programs for underpaid workers and their families make up 42 of total spending on Medicaid and CHIP the Childrens Health Insurance Program cash assistance Temporary Assistance for Needy Families or TANF food stamps Supplemental Nutrition Assistance Program or SNAP and. Federal government websites often end in gov or mil. 6 to 30 characters long.

Federal statute enacted by the 111th United States Congress and signed into law by President Barack Obama on March 23 2010. The FFCRA effective April 1. In 2016 fathers headed 20 percent of custodial families up from 16 percent in 1994.

Learn more about the House Build Back Better Act including the latest details and analysis of the Biden tax increases and reconciliation bill tax proposals The House Build Back Better plan would result in an estimated net revenue increase of about 1 trillion 125000 fewer jobs and on average less after-tax incomes for the top 80 percent of. A wide array of domestic and global news stories. A Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020.

You can see a few here. Over 50 organizations oppose the proposed healthcare plan that will make Americans will pay more for less. The average age of custodial parents was 38 years and a majority 55 percent of them had only one child eligible for child support services.

AARP opposes this legislation as introduced that would weaken Medicare leaving the door open to a voucher program that shifts costs and risks to seniors. In the United States Social Security is the commonly used term for the federal Old-Age Survivors and Disability Insurance OASDI program and is administered by the Social Security Administration SSA. Senate - Health Education Labor and Pensions.

35 Without better options parents must consider working fewer hours. By estimating the overall risk of health risk and health system expenses over the risk pool an insurer can develop a. 2000bb et seq permits the United States Department of Health and Human Services HHS to demand that three closely held corporations provide health-insurance coverage for methods of.

Following the Stabilisation Act of 1942 employers unable to provide higher salaries to attract or retain employees began to offer insurance plans including health care packages as a fringe benefit thereby beginning the practice of employer. The Affordable Care Act ACA formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare is a landmark US. Developed in response to the Great Recession the primary objective of this federal statute was to save existing jobs and create new ones as.

The American Recovery and Reinvestment Act of 2009 ARRA PubL. The Families First Coronavirus Response Act FFCRA was signed into law March 18 2020 as the second major legislative initiative designed to address COVID-19. Health insurance or medical insurance also known as medical aid in South Africa is a type of insurance that covers the whole or a part of the risk of a person incurring medical expensesAs with other types of insurance risk is shared among many individuals.

Justice Alito delivered the opinion of the Court. B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit organization which employs not. Internal Revenue Code the Alternative Minimum Tax AMT.

Must contain at least 4 different symbols. The AMT was originally designed as a way of making sure that wealthy taxpayers could not. News topics include politicsgovernment business technology religion sportsentertainment sciencenature and health.

Social welfare policy replacing the Aid to Families with Dependent Children AFDC program with the Temporary Assistance. Together with the Health Care and Education Reconciliation Act of 2010 amendment it. The 2001 act and the 2003 act significantly lowered the marginal tax rates for nearly all US.

The Personal Responsibility and Work Opportunity Reconciliation Act of 1996 PRWORA is a United States federal law passed by the 104th United States Congress and signed into law by President Bill ClintonThe bill implemented major changes to US. Families should notify child care providers if their child has COVID-19 and was in care during their infectious period and child care providers should notify people who spent more than a cumulative total of 15 minutes within a 24-hour time period in a shared indoor airspace eg classroom with someone with COVID-19 during their infectious. Alexander Lamar R-TN Introduced 04302015 Committees.

ASCII characters only characters found on a standard US keyboard. Those disparities are exacerbated by a lack of affordable child care which is one of the biggest expenses for families today. While most custodial families are headed by mothers an increasing proportion are headed by fathers.

The Build Back Better Act is a bill introduced in the 117th Congress to fulfill aspects of President Joe Bidens Build Back Better PlanIt was spun off from the American Jobs Plan alongside the Infrastructure Investment and Jobs Act as a 35 trillion Democratic reconciliation package that included provisions related to climate change and social policy.

How Does Congressional Budget Office Scoring Work The Atlantic

Student Loan Forgiveness Biden Debt Plan Cost Exceeds 400 Billion Cbo Says Bloomberg

Child Care And Pre K In The Build Back Better Act A Look At The Legislative Text

Celebrating Record Breaking Investments In Dc Kids Children S Law Center

Full Analysis Of Biden S Build Back Better 1 3 Spending Agenda Foundation National Taxpayers Union

The Aca Family Glitch And Affordability Of Employer Coverage Kff

Report Paid Child Care Strongly Linked To Income

The Effects Of A Minimum Wage Increase On Employment And Family Income Congressional Budget Office

The Fiscal Effects Of A Federal Paid Family Leave Program Yet Another Unfunded Entitlement The Heritage Foundation

Proposed Bill Would Help American Families Afford Child Care Center For American Progress

Cbo Extending Aca Subsidies Will Net 4 8m Sign Up Increase

Rep Peters Leads 95 Colleagues To Demand New Cbo Score On Republican Healthcare Changes Congressman Scott Peters

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

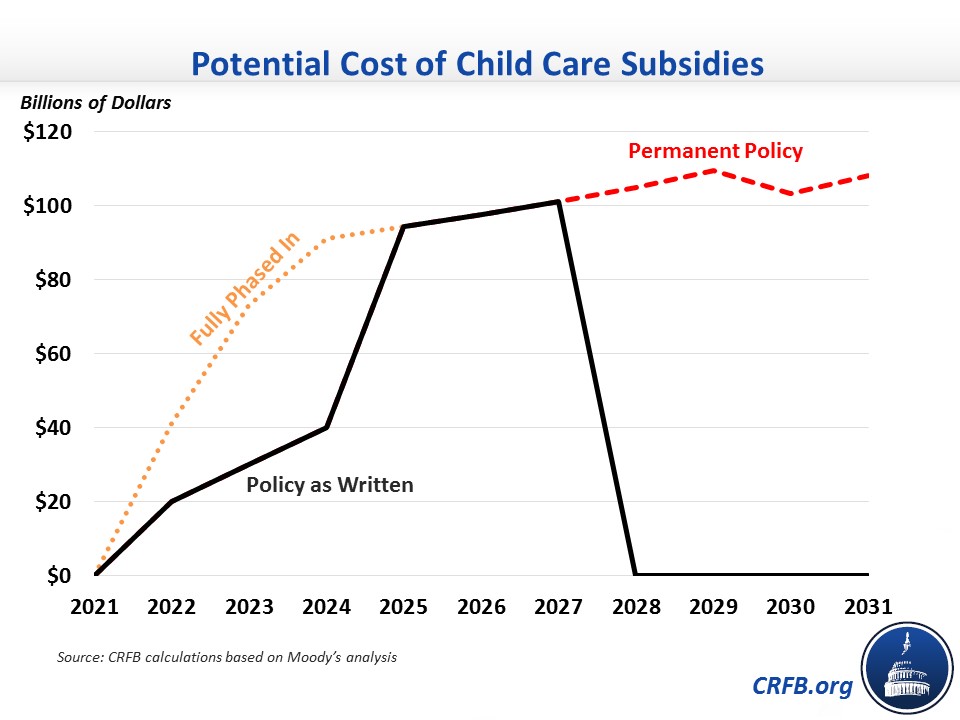

House Child Care Plan Cost Could Double If Made Permanent Committee For A Responsible Federal Budget

Child Welfare And Child Support The Preventing Sex Trafficking And Strengthening Families Act P L 113 183 Everycrsreport Com

Child Care Biden Plan To Cut Costs Could Actually Boost Expenses

Total Cost Of Universal Pre K Including New Facilities Penn Wharton Budget Model

Congress Needs Distribution Analyses To Make Informed Equitable Policy Choices And The Cbo Fair Scoring Act Would Deliver It Equitable Growth

The Child Care For Working Families Act Will Boost Employment And Create Jobs Center For American Progress