how to calculate nh property tax

Multiply the rate by 1000 and you get the property tax rate per 1000 of property value which is how the rate is usually stated. This manual was the result of a collaboration of dedicated professionals who volunteered their time and knowledge in the hope of shedding light on how the property tax works.

Alabama Property Tax H R Block

Different Methods to Calculate Property Tax.

. In this video I will go over calculating property tax on a house in Sacramento county before you buy. 19 hours agoThree thousand dollars is substantial. This calculator is based upon the State of New Hampshires Department.

The median property tax on a 24970000 house is 262185 in the United States. Property tax rates vary widely across New Hampshire which can be confusing to house hunters. The assessed value of the property.

Municipal local education state education county and village district if any. Are all made available to enhance your understanding of New Hampshires property tax system. Tax amount varies by county.

The assessed value 300000 is divided by 1000 since the tax rate is based on every 1000 of assessed value. Learn how much New Hampshire homeowners pay along with information about New Hampshire property tax rates deadline dates exemptions and how to appeal. State Education Property Tax Warrant.

The home Im looking up is in Antelope CA. This is your manual. Although the Department makes every effort to ensure the accuracy of data and information.

The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. New Hampshires tax year runs from April 1 through March 31. If a closing takes place on January 31st the seller would have already paid the December bill which covers through March 31st.

When you sell the property the basis reported on your tax return depends on whether the property is sold at a gain or loss. The buyer cant deduct this. The real estate transfer tax is also commonly referred to as stamp tax mortgage registry tax and deed tax.

New Hampshire Real Estate Transfer Tax Calculator. By law the property tax bill must show the assessed value of the property along with the tax rates for each component of the tax. The increase is due in part to inflation which the state uses to calculate taxable value on homes.

Take the Assessed Value of the property then multiply it by the Property Tax Rate and then divide it by 1000. For a more specific estimate find the calculator for your county. If a closing takes place on April 30th the tax bill covering that period will not be paid until July 1st.

Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only. Property tax bills in New Hampshire are determined using factors. The local tax rate where the property is situated.

New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. The TaxProper guide to New Hampshire property taxes. Capital Value System CVS.

Lets break down the calculation. The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New Hampshire Property Tax. While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country.

By Porcupine Real Estate Oct 4 2017 Real Estate. We genuinely invite commentary from the public. All offers due on Monday 37 at 300 PM.

The tax rate is calculated by dividing the number of tax dollars needed by the total assessed value of all taxable property less total exemptions in the Town. For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20. New Hampshire Property Tax.

In general practice one of these three methods is used to calculate the property tax. The median property tax on a 24970000 house is 464442 in New Hampshire. This means the buyer will need to reimburse the seller for taxes covering January 31st to March 31st.

The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New Hampshire Property Tax. This estimator is based on median property tax values in all of New Hampshires counties which can vary widely.

This states transfer tax is 075 of the sale paid by both buying and selling parties for a total aggregate of 15. In Claremont for example the property tax rate is 41 per 1000 of assessed value while in Auburn its only around 21 per 1000 of assessed value. New Hampshire has one of the highest average property tax rates in the country with only two.

To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the result by 1000. The result is the tax bill for the year. Understanding Property Taxes in New Hampshire.

New Hampshires real estate transfer tax is very straightforward. The market value of the property is calculated by the local. Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year.

If the Tax Lien remains unpaid for two years it. The property tax is calculated as a percentage of the propertys total market value under the Capital Value System. You can use the above formula to calculate the daily interest charge for the Tax Lien.

How to Calculate Your NH Property Tax Bill. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the. On average homeowners in New.

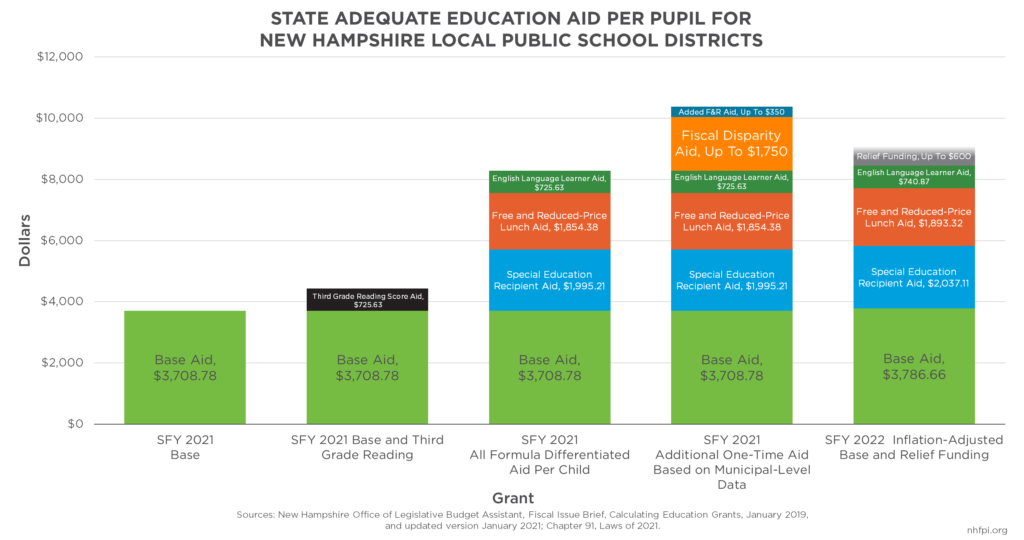

The School Funding Commission S Report At A Glance Reachinghighernh

Capital Gains Tax Calculator 2022 Casaplorer

Report School Funding Method Used Across N H Isn T Fair To Students Or Taxpayers

How To Calculate Transfer Tax In Nh

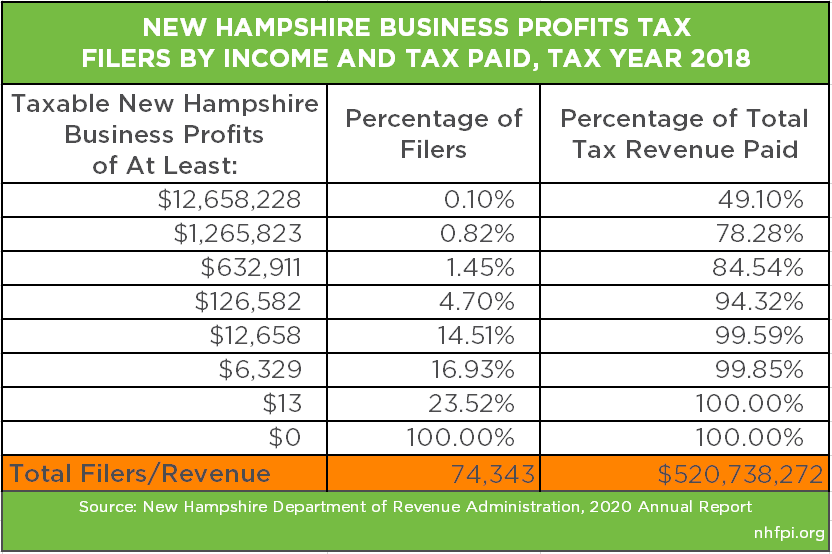

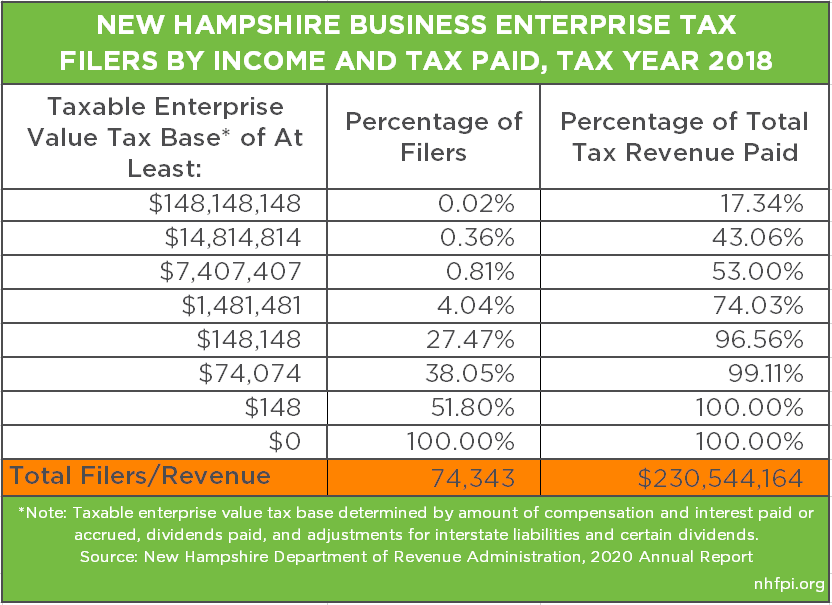

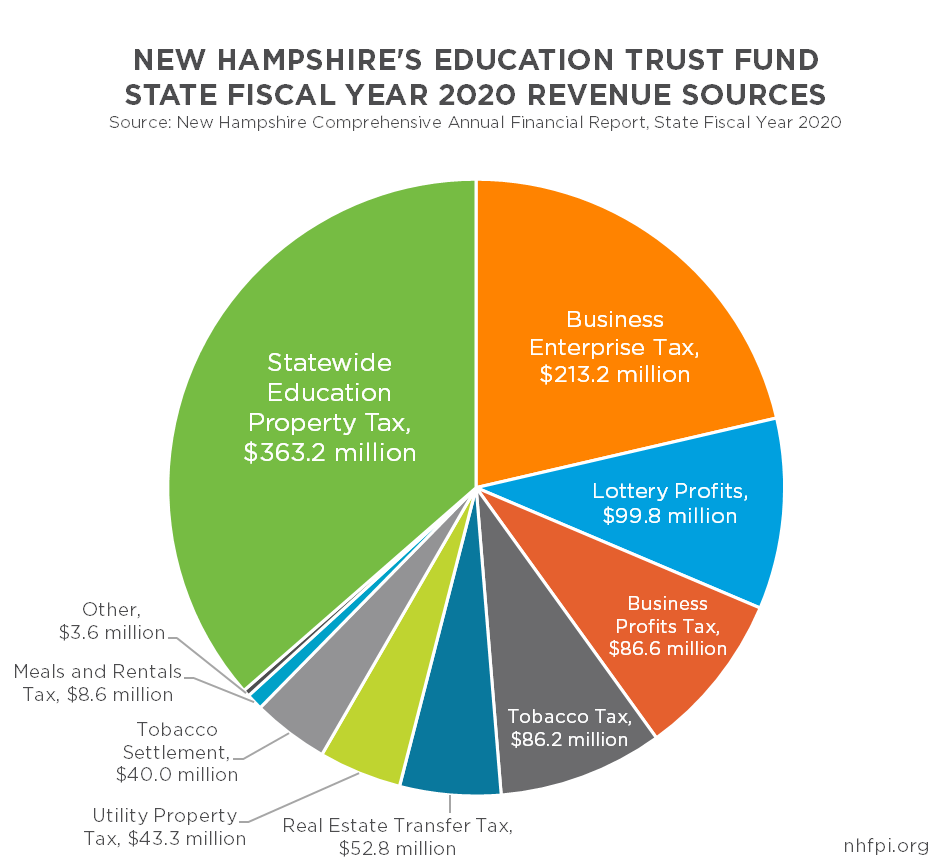

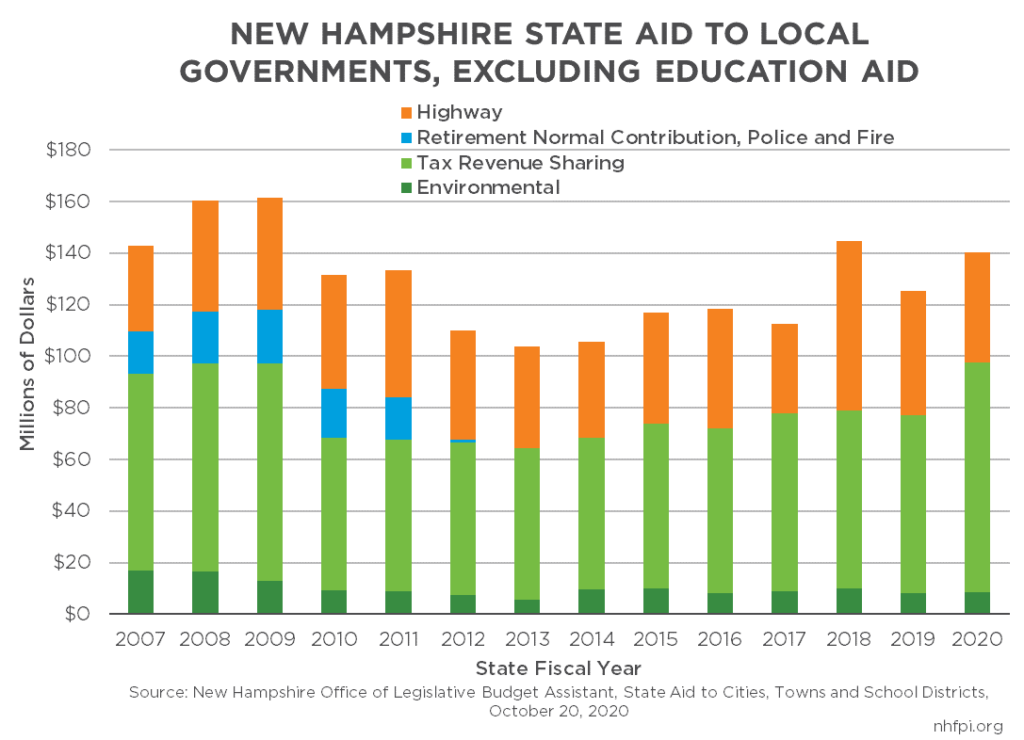

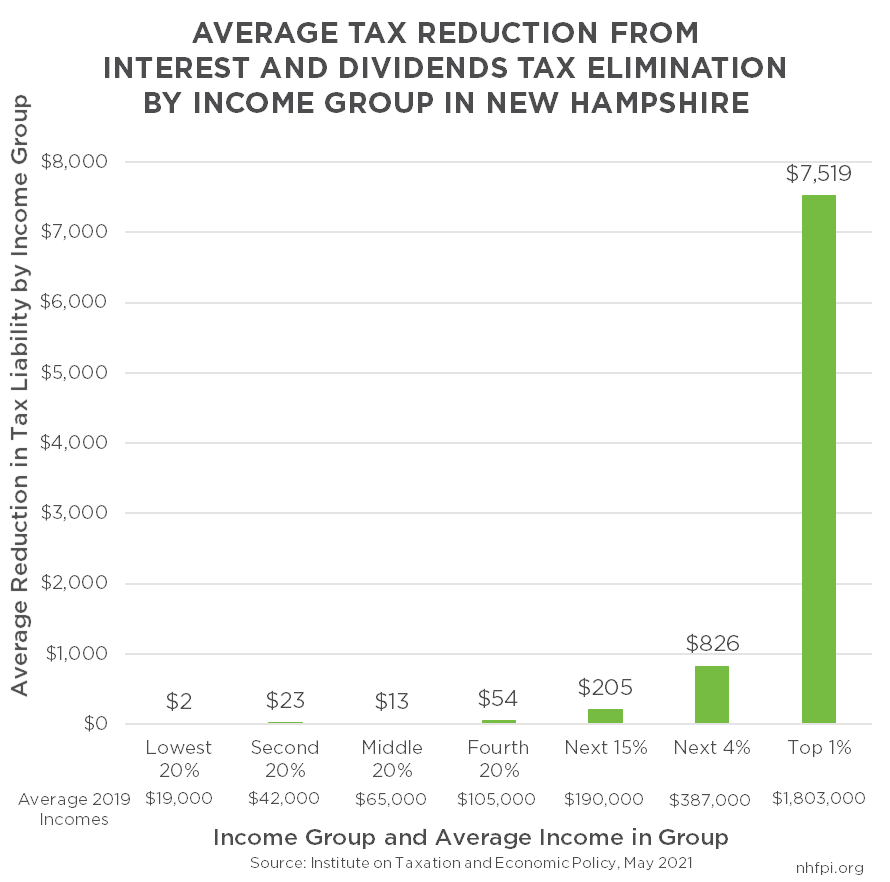

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

Property Taxes By State Quicken Loans

The School Funding Commission S Report At A Glance Reachinghighernh

Vermont Property Tax Calculator Smartasset

How To Calculate Transfer Tax In Nh

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

How To Calculate Transfer Tax In Nh

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

How The Courts Have Shaped Education Funding And What Comes Next Reachinghighernh